No, it’s not your imagination. Venture capitalists are paying more for startups. Much more. And they also have a lot of new funds from which to invest.

Here’s the Q2 2014 roundup:

VC deals

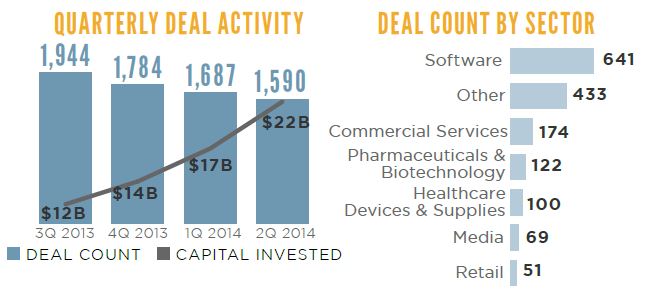

Venture capitalists disbursed $21.5 billion in Q2 2014, which is the largest such number since Q1 2000 (according to PitchBook). Moreover, it’s 68% higher than the $12.8 billion invested in Q2 2013. What’s interesting, however, is that more companies were funded in the year-earlier period (2,110 vs. 1,590). In fact, the number of deals has dropped for four consecutive quarters, while the amount of total investment has risen for four consecutive quarters.

VC valuations

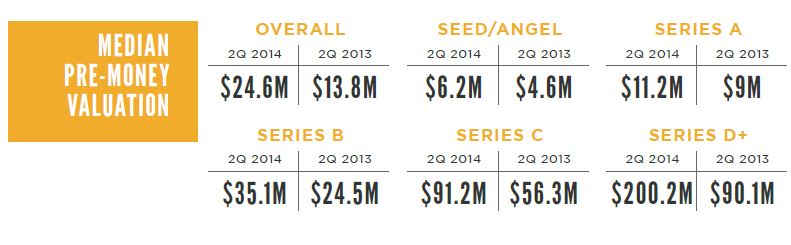

Median pre-money valuations for all deals climbed from $13.8 million in Q2 2013 to a whopping $24.6 million in Q2 2014 (according to PitchBook) The largest increase was in later-stage deals, but every single part of the VC lifecycle experienced substantial upward pressures.

VC fundraising

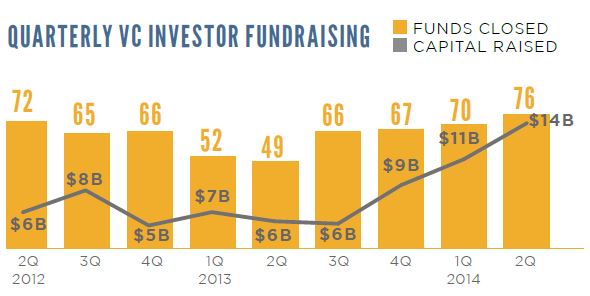

76 venture capital funds closed on $13.9 billion in Q2 2014, according to PitchBook. That’s a whopping increase over the 49 funds raising $6 billion in Q2 2013, and even over the 70 funds raising $11 billion in Q1 2014. The only caveat is that nearly one-third of the Q2 capital raise came from just four firms – reflecting the return of billion-dollar VC funds. Seven of the funds were first-timers, 85% met fundraising targets and the average time from launch to close was 15.4 months.

Exits

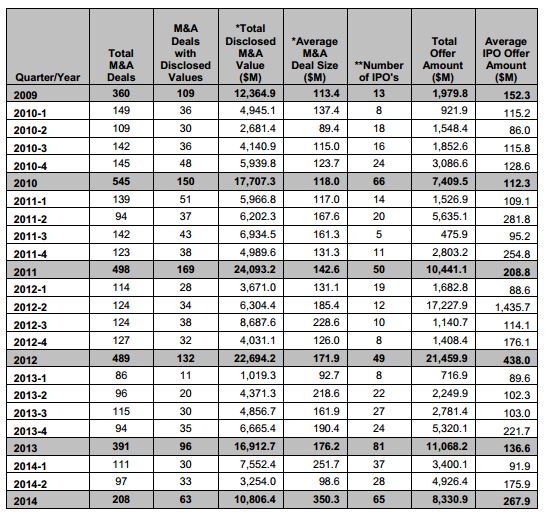

28 VC-backed companies priced IPOs on U.S. exchanges in Q2, raising $4.9 billion (according to Thomson Reuters and The National Venture Capital Association). This compares to 37 VC-backed companies raising $3.4 billion via IPOs during Q1 2014, and 22 VC-backed companies raising $2.25 billion via IPOs in Q2 2013. Sixteen of the 22 second-quarter IPOs were for life sciences companies, marking the fifth consecutive quarter of double-digit IPOs for the VC-backed life sciences sector. Twenty-two of the 28 offerings were for U.S.-based companies, although the largest single offering (JD.com, which raised $2 billion and listed on the NASDAQ) was for a Chinese company.

97 VC-backed companies were acquired in Q2, marking a slight decrease from Q1 (111) and essentially no change from the year-earlier period (96).

Sign up for Dan Primack’s daily email newsletter on deals and deal-makers: GetTermSheet.com